If you’re thinking of selling your house using owner financing, make sure you read this blog post to learn the 5 owner financing tips for sellers in Dallas…

There are several options available when it comes to selling a house. Here are a few examples:

-

Listing on the market: You can choose to list your house on the market through a real estate agent or by yourself. Potential buyers will make offers, and you can negotiate to reach a final sale price.

-

Working with a real estate buying company: Companies specializing in real estate buying, like Higher Home Buyer, can provide a fair all-cash offer for your house. This option can offer a quicker sale process and eliminate the need for traditional financing.

-

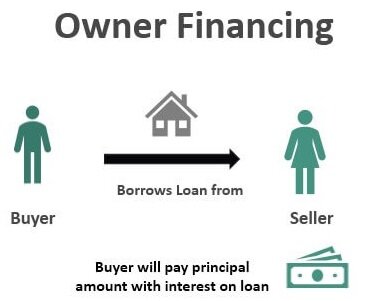

Owner financing: Another option is to consider owner financing, where you act as the bank for the buyer. In this scenario, the buyer makes payments directly to you over time, typically with interest.

Each method has its own advantages and considerations. It’s essential to evaluate the specific circumstances of your situation and choose the approach that aligns with your goals and priorities as a seller. Consulting with a real estate professional or financial advisor can also provide valuable guidance in making the right decision.

Owner financing is a valuable but under-used strategy to sell your house. It’s where you offer terms to the buyer to pay you regular payments (just like a mortgage). Here are 5 owner financing tips for sellers in Dallas…

Owner Financing Tip #1: Don’t Focus Only On Price

1 of 5 Owner Financing Tips For Sellers. Indeed, while price is an important factor when selling a house, there are other considerations that can be equally or even more valuable to a seller. Of course, you’ll want to find a price that is fair for both of you but there are other considerations as well (which could benefit you more than the asking price).

Owner Financing Tip #2: Timeline

2 of 5 Owner Financing Tips For Sellers. Considering the timeline for receiving payments is an important aspect when selling a house. While banks may offer various mortgage options ranging from 5 to 25 years, it’s crucial to determine the payment duration that aligns with your financial goals and preferences.

If you prefer a shorter timeline and don’t want to wait for payments over a long period, you may opt for a shorter payment term or consider alternative financing arrangements that allow for quicker receipt of funds such as a balloon payment.

On the other hand, it’s essential to consider the buyer’s perspective as well. They might have their own financial goals and preferences regarding the payment timeline. Some buyers may prefer a shorter payment term to own the property outright quickly, while others may seek longer terms for more manageable monthly payments.

Negotiating the payment timeline with the buyer can be a crucial aspect of reaching a mutually beneficial agreement. Finding a balance that meets both parties’ needs, and financial situations can lead to a successful and satisfying transaction!

Owner Financing Tip #3: Terms

3 of 5 Owner Financing Tips For Sellers. You’re absolutely right that the terms of the deal are crucial and often overlooked when selling a house. These terms can have a significant impact on the overall profitability and success of the transaction. Here are some important terms to consider:

-

Down payment: You have the flexibility to determine the amount of down payment you require from the buyer. A higher down payment can provide you with more immediate funds and potentially reduce the risk of default.

-

Repayment penalties: It’s important to consider whether you want to include any penalties for early repayment or late payment. Early repayment penalties can protect your investment by ensuring that the buyer adheres to the agreed-upon payment schedule. Late payment penalties can provide a financial incentive for buyers to make timely payments.

-

Interest rate: The interest rate you charge will impact the overall return you receive from the sale. Consider market rates, risk factors, and the buyer’s financial situation when determining the interest rate. It’s important to strike a balance between a competitive rate that attracts buyers and a rate that provides a fair return for you as the seller.

Taking the time to carefully negotiate and determine these terms can help you create a deal structure that meets your financial goals and aligns with the buyer’s needs. It’s advisable to consult with professionals such as real estate agents or attorneys who can provide guidance on setting appropriate terms and protecting your interests throughout the process.

Owner Financing Tip #4: Protect Yourself

4 of 5 Owner Financing Tips For Sellers. You raise an important point about protecting yourself when entering into a real estate agreement, even with someone you trust. Here are a couple of measures you can take to safeguard your interests:

-

Insurance: It’s essential to ensure that both parties have adequate insurance coverage. Homeowner’s insurance and liability insurance can provide protection in the event of unforeseen circumstances, such as damage to the property or liability claims. It’s advisable to consult with an insurance professional to understand the appropriate coverage for your specific situation.

-

Performance deed: Including a clause in the agreement that allows you to take back the property due to missed payment without having to go through the foreclosure process as an additional layer of protection. This ensures that you can recover the property quickly and resell it if necessary.

- 3rd Party Loan Servicing: These companies will hold onto the terms of the loan and keep a paper trail for both parties that payments are (or have not) been paid. This will allow for a smoother transfer if you ever have to enforce the performance deed.

By incorporating these protective measures into the agreement, you can minimize potential risks and ensure that you have legal and financial safeguards in place. It’s always wise to seek professional advice and guidance to ensure that the agreement is properly structured and protects your rights and interests.

Owner Financing Tip #5: Build Contingencies

5 of 5 Owner Financing Tips For Sellers. Most of your owner financing agreement will be built around the “ideal plan” – of what would happen if everything goes perfectly. But sometimes things happen outside of our control, so building contingencies allow you to make better decisions if the unexpected happens. For example, what if the buyer no longer wants the house, or can longer pay, or wants to pay early, or wants to use the house in a different way than expected? Or what if your circumstances change and you no longer want to sell or you need to sell even faster? Agree to the contingencies with your buyer ahead of time and the arrangement will be so much smoother.

Are you thinking about selling your house?

If you’re thinking of selling and are exploring your options, consider selling directly to us. If you don’t want to go through the hassle and headache of selling to the market then we might be able to help. Call our team at (214) 989-4949 or click here now and fill out the form and we’ll give you a fair all-cash offer on your house.

Recent posts you might also like…

- 5 Tips For Selling Your Mobile Home In DallasSelling your mobile home in Dallas can be a quick and easy process when you have a plan in place. While certain selling methods work for some homeowners, others are better served in other ways! There are many routes you can take when it comes to selling. Learn more about your options and get our … Continued

- 4 Improvements to Make Before Selling Your Mobile Home In DallasBefore selling your mobile home in Dallas, there are improvements you can make to add value to your property. Learn about these improvements and the selling options available to you in our latest post! #1 – Make It Energy Efficient People are often drawn to the allure of mobile homes due to the promise of … Continued

- How To Get The Best Price For Your Manufactured Home in DallasWhen selling your manufactured home in Dallas, you’ll want to get the best price possible without having to have it on the market for a long time. In our latest post, we offer some tips to do just that! Selling a manufactured home can present unique challenges compared to selling a traditional single-family home. The pool of … Continued

- 4 Benefits of Selling A Mobile Home To A Dallas InvestorIf you want to sell a mobile home in Dallas or the surrounding areas, turning to a professional investor may not have even been on your radar. However, many investors, such as the team at Higher Home Buyer, pay excellent prices and can make the process quick and easy instead of a long and drawn … Continued

- Pro and Cons of Hiring an Agent vs. Selling to an Investor in DallasReady to sell your house in Dallas or the surrounding areas? Learn more about the pros and cons of hiring an agent vs. selling to an investor in Dallas! What many homeowners may not fully grasp is the breadth of options available when it comes to selling their property. While the traditional route of hiring … Continued