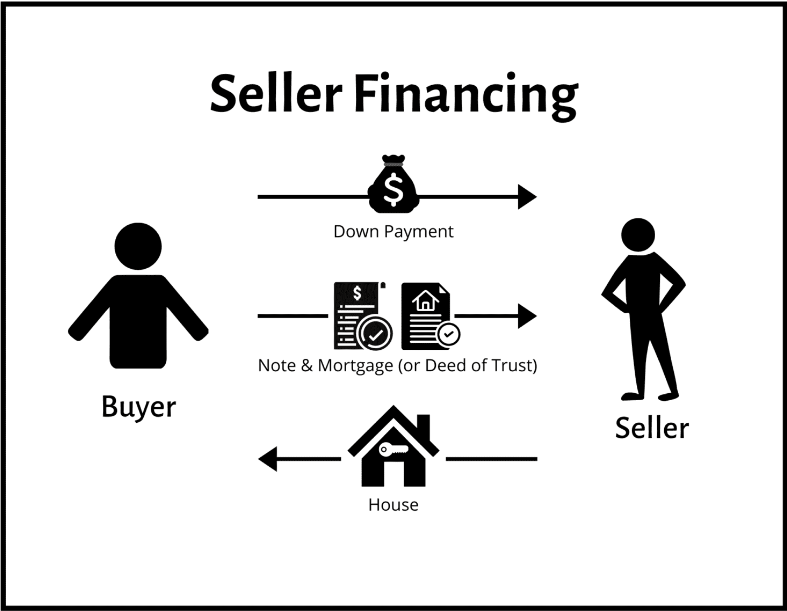

How to sell a house by owner financing in any market is oversimplification in this image. This strategy is the best in a down or buyer’s market because it will allow you to make the most profit. How to sell a house by owner financing in any market offers homeowners a flexible approach to selling their property. This method is particularly advantageous in a down or buyer’s market, as it provides the opportunity to maximize profit despite market conditions.

Wondering how to sell a house by owner financing in any market? With changes to the economy in recent years, homeowners are discovering alternative selling methods not commonly used by real estate agents. You no longer have to sell through an agent – you can sell on your own or even accept seller financing. Selling a house by owner financing in any market offers homeowners a viable alternative to traditional real estate transactions. With the flexibility to negotiate terms directly with buyers and potentially attract a wider pool of interested parties, owner financing provides an opportunity for sellers to take greater control of the sales process. Despite some agents’ reluctance due to commission concerns, more homeowners are recognizing the benefits of selling their properties independently. Whether you want to maximize profits, expedite the sale, or explore alternative options, owner financing provides a viable solution in today’s real estate landscape. If you’re wondering how to sell a house by owner financing in Texas , keep reading this blog post and we’ll walk you step-by-step through the process…

Step 1. Determine whether you own the house outright or still have a mortgage

In various states across the country, the rules regarding owner financing can differ, particularly when it comes to properties with existing mortgages. While some states permit owner financing regardless of whether there is an existing mortgage on the property, others have regulations in place that restrict or prohibit this practice under certain circumstances. Therefore, the first crucial step in determining whether owner financing is a viable option for you is to ascertain the status of any existing mortgage on your property. This involves reviewing your loan documents or contacting your mortgage lender directly to confirm the specifics of your mortgage arrangement. Once you have clarity on whether there is a mortgage on your property, you can then proceed to explore the feasibility of offering owner financing based on the regulations in your state. Understanding the legal framework and requirements surrounding owner financing in your jurisdiction is essential to ensure compliance and mitigate any potential risks or complications that may arise. By taking the time to assess your mortgage status and familiarize yourself with the relevant laws, you can make informed decisions regarding the possibility of offering owner financing for your property, ultimately facilitating a smoother and more successful transaction process.

Step 2. Talk to a real estate attorney for help in crafting an agreement

When you opt for seller financing, it’s akin to taking on the role of a bank. The buyer agrees to make a down payment to you and then continues to make monthly payments until they’ve paid off the entire purchase price, at which point ownership of the house transfers to them. This arrangement can offer benefits like steady income over time, but it’s essential to approach it with caution and ensure that you’re safeguarded against potential risks. That’s why it’s highly recommended to consult with a real estate attorney who can provide guidance and ensure that you’re complying with all applicable federal, local, and state laws. They can help you draft a legally binding contract that protects your interests while also ensuring that the transaction proceeds smoothly and ethically. By seeking professional advice and taking the necessary precautions, you can minimize the likelihood of encountering legal issues or disputes down the line, allowing you to proceed with confidence in your seller financing arrangement. (If you need the name of a good real estate attorney, get in touch with us and we can make an introduction.)

Step 3. Market your house online and offline

Once you’ve sorted out all your paperwork, it’s time to spread the word that your house is up for sale. Make sure to mention that you’re offering seller financing, as this can attract more potential buyers. There’s no set limit on how much marketing you should do – the more you can do, the greater your chances of finding the right buyer. You can advertise in local newspapers, online platforms, and social media. Consider putting up signs in your neighborhood or hosting open houses to showcase your property. The goal is to reach as many interested parties as possible and make them aware of your seller financing option. Don’t hesitate to get creative with your marketing efforts to stand out and generate more interest in your property. Remember, the key is to cast a wide net and maximize exposure to increase your chances of finding the perfect buyer for your house.

Step 4. Work with potential buyers

As your marketing efforts begin to attract potential buyers, it’s essential to engage with them and showcase your house. Arrange viewings and walkthroughs to give interested parties a firsthand look at what your property has to offer. When someone expresses interest and makes an offer on your house, it’s time to enter negotiations. This involves discussing the price and terms of the sale with the buyer in order to reach a mutually beneficial agreement. Negotiation is about finding common ground where both parties feel satisfied with the outcome. It’s crucial to remain open-minded and flexible during this process, considering factors such as the buyer’s financial situation and their needs. By working together to find a fair middle ground, you can ensure a win-win situation for both yourself and the buyer. Once an agreement has been reached, it’s time to finalize the deal by signing the necessary paperwork. This legally binds the sale and marks the beginning of the transition of ownership from you to the buyer. Throughout this entire process, clear communication and a willingness to collaborate are key to ensuring a smooth and successful transaction.

Step 5. Collect the down payment and hand over the keys

After reaching an agreement on the price and signing all the necessary paperwork, the next step is to collect the down payment from the buyer and officially transfer ownership of the house. This often involves handing over the keys to the new owner as a symbolic gesture of the property’s transfer. However, it’s important to note that in many cases, you will retain ownership of the house even after the sale is finalized. The buyer will continue to make regular payments, typically on a monthly basis, until the full purchase price has been paid off. During this time, you’ll act as the lender, receiving payments from the buyer and overseeing the repayment process. Once the house is fully paid off, ownership will officially transfer to the buyer, completing the transaction. This arrangement allows for a gradual transition of ownership and provides both parties with a clear understanding of their rights and responsibilities throughout the payment period. It’s essential to adhere to the terms outlined in the sales agreement and maintain open communication with the buyer to ensure a smooth and successful transition of ownership.

If you’re wondering how to sell a house by owner financing in Texas , we can help. We might be able to offer you some advice or even work out an owner financing arrangement where we buy your house from you. Talk to our team at (214) 989-4949 or by clicking here to fill out the form.

Recent posts you might also like…

- 5 Tips For Selling Your Mobile Home In DallasSelling your mobile home in Dallas can be a quick and easy process when you have a plan in place. While certain selling methods work for some homeowners, others are better served in other ways! There are many routes you can take when it comes to selling. Learn more about your options and get our … Continued

- 4 Improvements to Make Before Selling Your Mobile Home In DallasBefore selling your mobile home in Dallas, there are improvements you can make to add value to your property. Learn about these improvements and the selling options available to you in our latest post! #1 – Make It Energy Efficient People are often drawn to the allure of mobile homes due to the promise of … Continued

- How To Get The Best Price For Your Manufactured Home in DallasWhen selling your manufactured home in Dallas, you’ll want to get the best price possible without having to have it on the market for a long time. In our latest post, we offer some tips to do just that! Selling a manufactured home can present unique challenges compared to selling a traditional single-family home. The pool of … Continued